Securing Your Future: Key Steps for Retirement Planning in Australia

As retirement approaches, ensuring financial security becomes paramount. This guide outlines essential steps to navigate the transition smoothly, with a focus on Australia’s specific context. Seeking guidance from a financial adviser or planner can significantly enhance your retirement strategy. James Hayes FP, based in Caringbah and serving the Sutherland Shire, is a trusted name in financial advice and can help you achieve your retirement goals.

1. Understanding the Role of a Financial Adviser:

– A financial adviser offers personalized guidance on managing finances, investments, and retirement planning.

– They assess your financial situation, goals, and risk tolerance to develop a tailored retirement strategy.

– In Australia, financial advisers must hold relevant qualifications and licenses, ensuring they adhere to regulatory standards.

2. Importance of Financial Planning:

– Financial planning involves setting goals, creating a roadmap, and regularly reviewing and adjusting your plan.

– A financial planner helps optimize your income, investments, and superannuation to achieve long-term financial security.

– They provide expert advice on maximizing government benefits and minimizing tax liabilities in retirement.

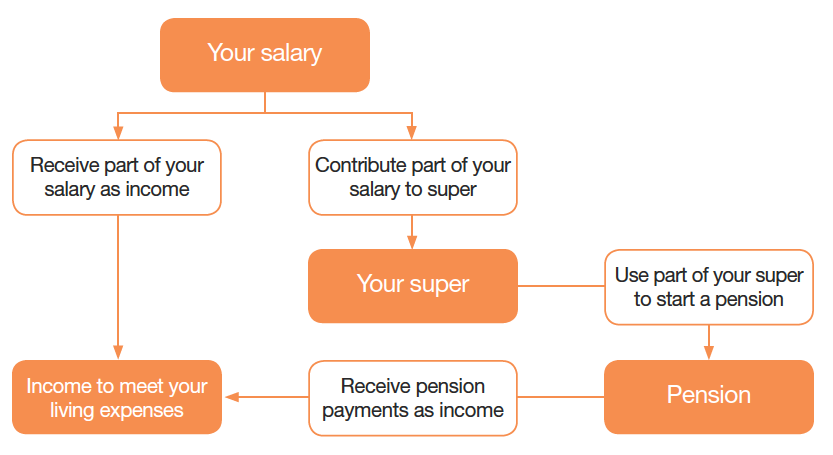

3. Superannuation Advice:

– Superannuation (super) is a cornerstone of retirement planning in Australia, designed to provide income in retirement.

– A financial adviser can help you understand super options, consolidate multiple accounts, and choose appropriate investment strategies.

– They assist in optimizing contributions and accessing super benefits efficiently during retirement.

4. Transition to Retirement:

– The transition to retirement (TTR) strategy allows individuals to access their super while still working.

– Financial advisers evaluate TTR options, including salary sacrificing, to boost retirement savings and manage tax implications effectively.

5. Finding a Trusted Financial Adviser:

– Researching and selecting a reputable financial adviser is crucial for a successful retirement plan.

– James Hayes FP, located in Caringbah and serving the Sutherland Shire, offers personalized financial advice tailored to your needs.

– With a commitment to client-centric service and extensive experience in Australian financial markets, James Hayes FP is your partner in achieving financial security in retirement.

Conclusion:

Preparing for retirement requires careful planning and expert guidance. By partnering with a trusted financial adviser like James Hayes FP, you can navigate the complexities of retirement planning with confidence. Take the essential steps today to secure your financial future in Australia.

Read More – How to Conquer Common Travel Challenges For an Amazing Trip